Deciphering Nature and Climate

Climate and nature are two sides of the same coin. Changes in the climate can create instability in nature, while nature regulates and stabilizes the climate. In an effort to understand how our economic activities are impacting both, new frameworks have emerged to guide companies and investors on how to measure climate (TCFD) and nature (TNFD). Climate and nature risk disclosures are meant to provide transparency around long-term and existential risks to our financial system, and provide levers for finance to direct capital towards a sustainable economy.

Climate and nature disclosures will become a standard part of financial reporting.

ESG is just the beginning. As measurement and reporting tools mature, you can expect that climate and nature disclosures will become a standard part of financial reporting over the next few years. Industry sustainability leaders and innovative new companies will reinvent business, leaving behind those companies that refuse to change.

Though they are similar in importance, the challenges around measuring risk are different for climate and for nature. For measuring climate risk, there is a set of globally accepted scientific models that describe how climate hazards will evolve under different scenarios of GHG emissions. Though these models are not easy to navigate - you basically need a PhD in climate science to interpret them - there are plenty of digital tools and services that can interpret these models for you to measure your impacts and risks associated with climate change.

Nature, on the other hand, does not have an equivalent set of modeled scenarios from which to measure risks. Instead there are numerous fragmented datasets of varying quality and scientific rigor, each measuring some different aspect of nature but none with a clear answer.

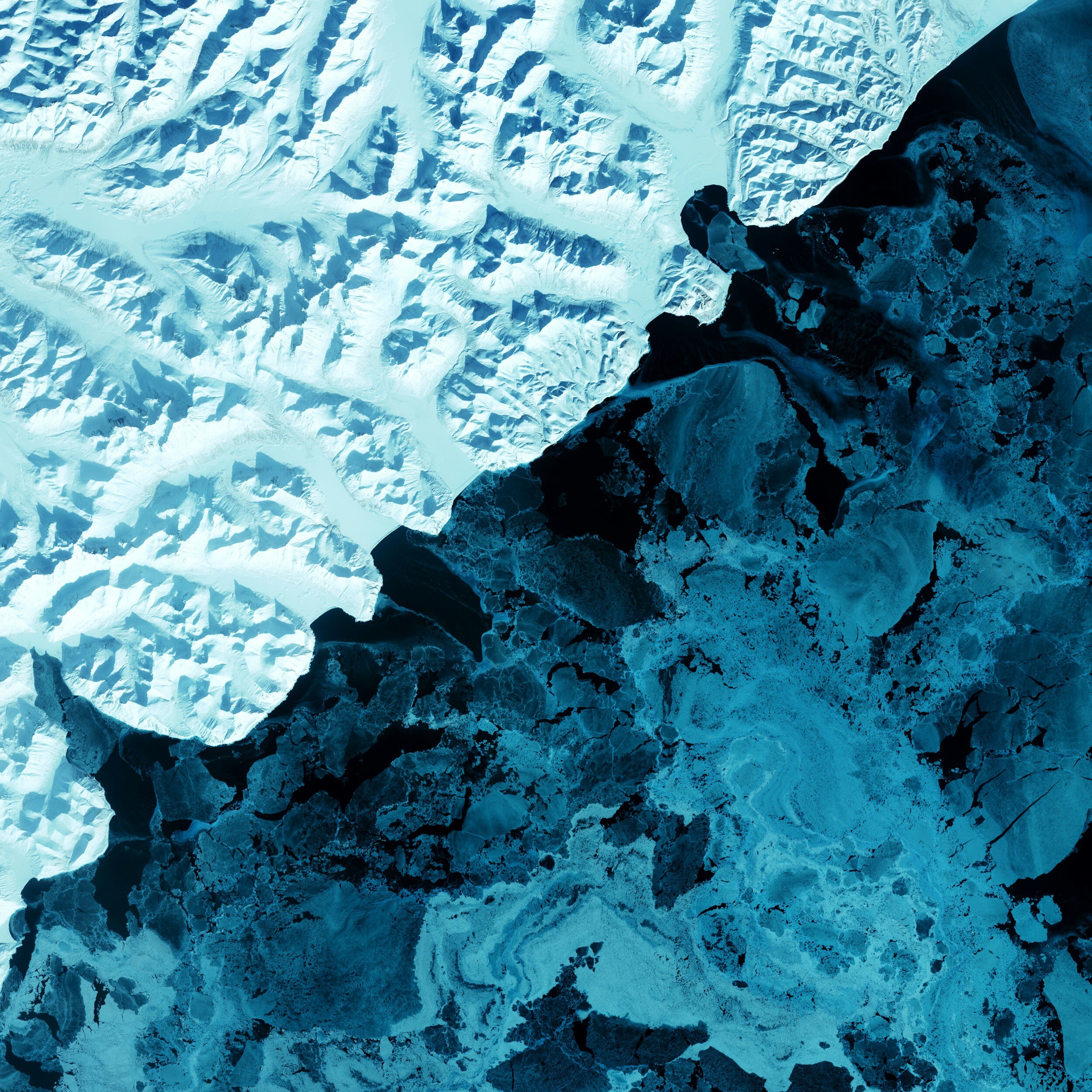

Even global datasets are incomplete in their geographic coverage. No one has yet gone out and measured the biodiversity status of every place on earth. Instead we have aggregations of biodiversity measurements that provide patchwork coverage of the earth.

Industry sustainability leaders and innovative new companies will reinvent business, leaving behind those companies that refuse to change.

This is why it’s important, when measuring biodiversity and nature, to incorporate many different datasets in an assessment, to build the most complete picture possible. The challenge then is understanding which datasets can be combined and how to deliver science-based insights about nature risks and opportunities.

Dunya Analytics offers a digital platform that not only aggregates the best available nature and biodiversity datasets, it also applies transparent methodologies developed by industry-leading scientists to calculate risks and opportunities into actionable results. Tools like these are critical for making the science accessible to every business.

The time to start measuring nature impacts and risks is now. Understanding nature risks completes the climate picture. And there is sufficient data already, and new data emerging every day, to start taking concrete actions toward becoming nature positive.